With a daily turnover of $7.5 trillion per day, the Foreign Exchange Market is the largest and most liquid financial market in the world.

Highlights

- The size of the entire Foreign Exchange market is estimated more than 2.4 quadrillion USD

- More than 170 currencies are traded on the global Foreign Exchange market

- USD is a component of 88.5% of the overall FX trading turnover, while EUR/USD remains the largest currency pair (22.7%)

- London remains the most important Forex center in the world, followed by New York

- Five organizations hold a 44% share of the entire global Forex market

- There are over 14 million active Forex traders worldwide, most of them are located in Asia, and the great majority of them are men (89%)

- Retail trading accounts account only for 5.5% of the entire market’s turnover

- The MetaTrader platforms dominate the online Foreign Exchange market (91%)

The Size of the Foreign Exchange Market

The worth of the entire Foreign Exchange market is estimated at more than 2.4 quadrillion USD. According to BIS’s 2022 triennial survey, these are some facts:

- The turnover of the Foreign Exchange market reached in 2022 a record of US$ 7.5 trillion per day (average)

- Growth is 4.5% per annum (During 2007-2022, the growth was 5.6% per annum)

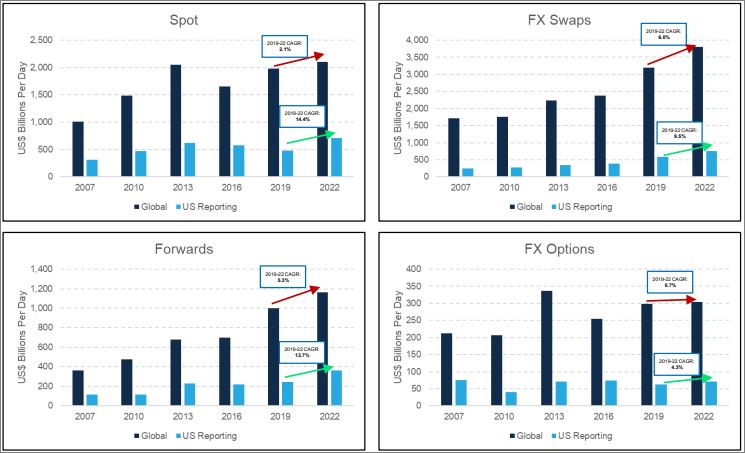

Forex Market Turnover by Instrument Type

According to the BIS Triennial Central Bank Survey of Foreign Exchange, this is the turnover per instrument type:

• Spot market $2.1tn/day in 2022; - CAGR up by 2.1% since 2019; - Up 0.3% since 2013

• FX Swaps $3.8tn/day in 2022; - CAGR up by 6.0% since 2019; - Up 6.1% since 2013

• FX Forwards $1.1tn/day in 2022; - CAGR up by 5.3% since 2019; - Up 6.2% since 2013

• FX Options $0.3tn/day in 2022; - CAGR up by 0.7% since 2019; - Down 1.1% since 2013

Chart: FX Turnover by Instrument Type (source BIS)

Note that the BIS Triennial Central Bank Survey is the most comprehensive source of information on the size and structure of global over-the-counter (OTC) markets in foreign exchange (FX) and interest rate derivatives.

Top Ten Currency Pairs

• USD is a component of 88.5% of FX trading - vs 87% in 2013 and 88.3% in 2019

• EUR/USD remains the largest currency pair - 22.7% overall market share - vs 24.1% in 2013 and 24.0% in 2019

• USD/CNY now 4th largest currency pair - 6.6% overall market share - vs 2.1% in 2013 and 4.1% in 2019 - Overtakes USD/CAD and AUD/USD

• Largest overall declines since 2019* - USD/RUB: -41.3% CAGR - USD/TRY: -27.6% CAGR (*of 39 currency pairs published)

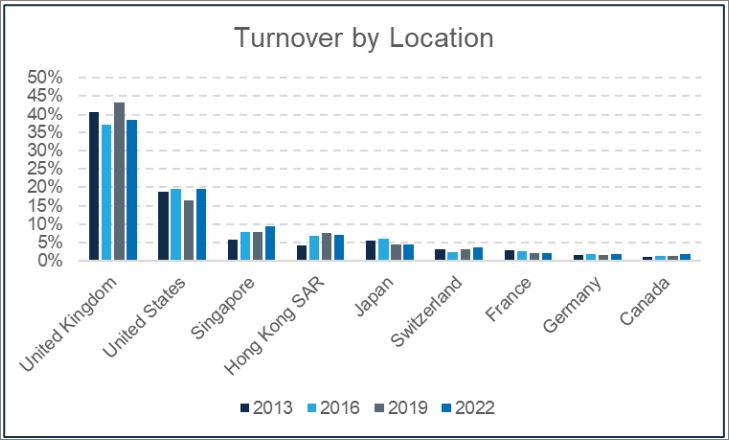

Forex Market Turnover by Location

London remains the most active Forex center in the world, followed by New York.

Chart: FX Turnover by Geographic Location (source BIS)

Table: Location and Growth Rate (2022 vs 2019)

| Growth Rate per Location | 2022 vs 2019 (Growth) |

| United Kingdom | 2% |

| United States | 12% |

| Singapore | 13% |

| Hong Kong SAR | 3% |

| Japan | 5% |

| Switzerland | 10% |

| France | 9% |

| Germany | 14% |

| Canada | 16% |

| China | 4% |

| TOTAL | 4.50% |

Forex Market Turnover by Counterparty by Global and US reporting

• Growth in FX turnover is focused on the growth of trading between reporting dealers:

- Reporting dealers 11.2% CAGR

- Other Financial: 0.3% CAGR

- Non-Financial: -3.3% CAGR

• In the US, reporting dealers have a 60% market share

- 72.6% in FX swaps

- 52.5% in Spot

• Activity by non-financial customers falling globally, but more quickly in the US

-7.2% CAGR in the US across all instruments

Key Players in the Forex Market

According to the Euromoney ‘Foreign Exchange Survey’ five organizations hold a 44% share of the entire global Forex market.

| Rank | Bank | Market Share % |

| 1 | Deutsche Bank | 10.89% |

| 2 | UBS | 9.69% |

| 3 | JPMorgan | 8.67% |

| 4 | State Street | 7.66% |

| 5 | XTX Markets | 7.14% |

| 6 | Jump Trading | 5.60% |

| 7 | Citi | 4.54% |

| 8 | Bank of New York Mellon | 4.30% |

| 9 | Bank of America | 3.73% |

| 10 | Goldman Sachs | 3.65% |

The Average Forex Trader

The following statistics focus on the profile of the average Forex trader:

- There are over 14 million active online Forex traders

- Most Forex traders are located in Asia, followed by Europe and the United States

- Retail trading accounts account only for 5.5% of the entire market

- The great majority of Forex traders are men (89.0%)

- The majority of Forex traders are between 18 and 44 years old

- 28% between 35-44 age

- 27% between 18-34 age

- 21% between 45-54 age

- The majority of Forex traders are losing money (85%), only 15% trades profitably

- More than 2/3 of all Forex traders have no experience in trading on any other financial market

- Most Forex traders have been trading for 1-3 years (39%). They are followed by those who have been trading for 4-9 years account (23%). Traders who have been trading for less than a year account only for 18%, and those who have been trading forex for over 10 years account for 7%

- 2/3 of all Forex traders use daily technical analysis

- The MetaTrader platforms dominate the online Foreign Exchange market (91%). MT4 accounts for 85%

■ The Forex Market Statistics

CurrenciesFx.com (c)

Sources:

- BIS 2022 Survey: https://www.newyorkfed.org/medialibrary/microsites/fxc/files/2022/BIS_2022_Triennial_Central_Bank_Survey.pdf

- Euromoney Foreign Exchange Survey: https://www.euromoney.com/foreign-exchange-survey

- New York FED 2023 Survey: https://www.newyorkfed.org/medialibrary/Microsites/fxc/files/2023/Volume-Survey-Press-Release_07312023

- Bank of England 2023 Survey: https://www.bankofengland.co.uk/markets/london-foreign-exchange-joint-standing-committee/results-of-the-semi-annual-fx-turnover-survey-april-2023

> READ MORE ON RESEARCH