THE HISTORY OF MONETARY EMPIRES (ACCORDING TO RAY DALIO)

THE HISTORY OF MONETARY EMPIRES (ACCORDING TO RAY DALIO)

The legendary hedge fund manager Ray Dalio offers an insight into the dynamics that he saw when studying the rises and declines of the last three reserve currency empires (the Dutch, the British, and the American) and the six other significant empires (Germany, France, Russia, India, Japan, and China) over the last 500 years.

Monetary Patterns & Key Findings

After studying these past cases, he has identified clear patterns that occurred for logical reasons:

1. Behind the success and failure of great monetary empires, over time, there are giant cycles

2. 17 forces affect the big cyclical swings in wealth and power (check below)

3. Of the 17 forces, the debt cycle, the money and credit cycle, the wealth gap cycle, and the global geopolitical cycle are the most important to understand

4. Almost all debt busts, including the one we are now in, come about for basically the same reason over-borrowing

5. There are also ripple-effect patterns in all dimensions of life including culture, arts, etc

6. Human productivity is the most important factor driving wealth, power, and living standards to improve over time

Understanding the Economic Cycles

Most cycles in history happened for basically the same reasons. For example, the 1907-19 period began with the Panic of 1907, which, like the 1929-32 money and credit crisis following the Roaring ‘20s, was the result of boom periods becoming debt-financed bubbles that led to economic and market declines. Economic declines also happened when there were large wealth gaps that led to big wealth redistributions and a world war. The wealth redistributions, like those in the 1930-45 period, came about through large increases in taxes and government spending, big deficits, and big changes in monetary policies that monetized the deficits. This stress test and global economic and geopolitical restructuring led to a new world order in 1919, which was expressed in the Treaty of Versailles. That ushered in the 1920s debt-financed boom, which led to the 1930-45 period and the same things happened again.

MAJOR MONETARY LESSONS

Basic Monetary Lessons

The currencies of countries that are the richest and most powerful become the world’s reserve currencies, which gives them the privilege of being able to borrow more money, which gets them deeper into debt. That borrowing typically sustains its power beyond its fundamentals by financing both domestic over-consumption and the military and wars that are required to maintain its empire. This over-borrowing can go on for quite a while and even be self-reinforcing because it strengthens the reserve currency, which raises the returns of foreign lenders who lend to it. When the richest get into debt by borrowing from the poorest, it is a very early sign of a relative wealth shift.

Additional Conclusions

-

The leading country extends the empire to the point that it has become uneconomical to support and defend. As the costs of maintaining it become greater than the revenue, it brings in, the unprofitability of the empire further weakens the leading country financially. That is certainly the case for the US.

-

Economic success naturally leads to larger wealth gaps because those with wealth and power naturally work in mutually supportive ways to maintain the existing system, until the split becomes so large that it is perceived as intolerably unfair. This is an issue in the US.

-

When debts become very large the central banks lose their ability to stimulate debt and economic growth, and when there is an economic downturn, that leads to debt and economic problems and to more printing of money, which eventually devalues it.

-

When wealth and values gaps get large and there is a lot of economic stress, there are high probabilities of greater conflict between the rich and the poor, at first gradually and then increasingly intensely. That combination of circumstances typically leads to increased political extremism. For example, in the 1930s, increasingly extreme populists of the left became communists and those from the right became fascists.

-

When the rich fear that their money will be taken away and/or that they will be treated with hostility, that leads them to move their money and themselves to places, assets, and/or currencies that they feel are safer. If allowed to continue, these movements reduce the tax and spending revenue.

-

When these sorts of disruptive conditions exist, they undermine productivity; which shrinks the economic pie and causes more conflict about how to divide the shrinking resources well.

MAIN FORCES THAT DRIVE THE RISE AND FAILURE OF AN EMPIRE

17 forces that rule monetary empires

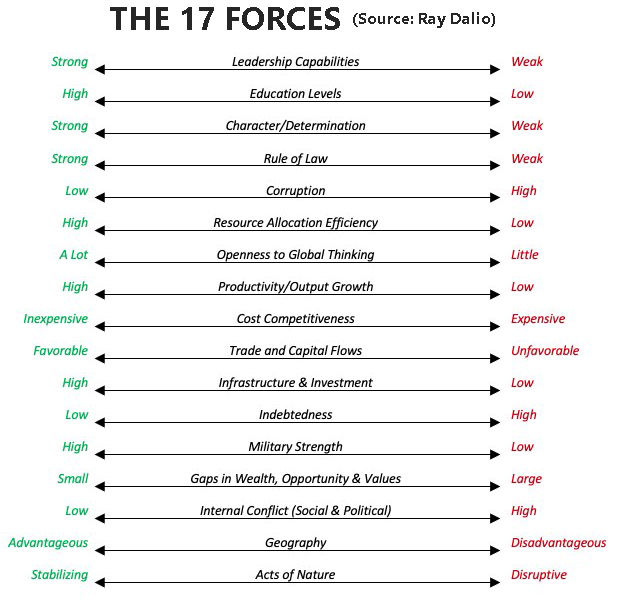

Always according to Ray Dalio, the following 17 items are the main forces that drive the rises and declines of monetary empires:

Image: 17 Forces

Mr. Dalio proposes to rank each country on a 1-10 scale for each attribute, beginning with 10 on the far left and 1 on the far right. If we add all these rankings up, the higher the number, the greater the probability of the country rising on a relative basis. The lower the number, the more likely it will fall.

The Periods of Destruction and Restructure

The bad periods of destruction and restructuring via depression, revolution, and war, typically take about 10 to 20 years, though variations in the range can be much larger. They are followed by more extended periods of peace and prosperity in which smart people work harmoniously together and no country wants to fight the world power because it’s too strong. These peaceful periods last for about 40 to 80 years, though variations in the range can be much larger. Within these cycles are smaller cycles like the short-term debt/business cycle which lasts about 7 to 10 years.

Where We Are Now

It is now 75 years later (2020), and we are classically near the end of a long-term debt cycle when there are large debts and classic monetary policies don’t work well for the world’s reserve currency central banks. This is happening as we are simultaneously in a deep economic and debt contraction that is producing income and balance sheet holes for people, companies, nonprofit organizations, and governments, while politically fragmented central governments are trying to fill in these holes by giving out a lot of money that they are borrowing.

Central banks are helping them do that by monetizing government debt. At the same time, there are big wealth and value gaps and there is a rising world power that is competing with the leading world power in trade, technology development, capital markets, and geopolitics.

We have great human capital and thinking technologies that can help us see how to best deal with these challenges and do the inevitable restructurings well. If we can all deal with each other well, we will certainly get past this difficult time and move on to a new prosperous period that will be quite different.

■ The Rise and Fall of Monetary Empires

Original article by Ray Dalio, edited by CurrenciesFx.com (c)

Source: https://www.linkedin.com/pulse/chapter-1-big-picture-tiny-nutshell-ray-dalio

> READ MORE