KAMA is a trend-following indicator that aims to serve multiple missions, for example, to identify the trend and estimate key time turning points.

Introduction to Kaufman's Adaptive Moving Average

Kaufman's Adaptive Moving Average (KAMA) is designed to evaluate market noise and market volatility. The indicator was developed by Perry Kaufman in 1995 {Smarter Trading, Improving Performance in Changing Markets. New York: McGraw-Hill, Inc.}. You can use the KAMA indicator when trading with the MT4/MT5 platforms.

KAMA Settings

The recommended settings by Perry Kaufman include KAMA(10,2,30).

There are two ways to use KAMA:

(i) A longer-term KAMA to define the overall trend (10,5,30)

(ii) A shorter-term KAMA for trading signals (10,2,30)

The second (shorter-term) KAMA can generate trade signals when the price crosses above/below KAMA.

Analysis and Objectives

Chartists should observe price crosses and directional changes between KAMA and the current price, as follows:

□ Price cross above or below standard KAMA indicates directional changes (reversals)

□ Price cross above or below shorter-term KAMA can indicate potential trading signals

□ Time filtering to the crossovers can reduce the number of signals (require several periods above/below KAMA to confirm signals)

□ Price Filtering can be used also for the confirmation of any signal (require the price to exceed KAMA by a certain percentage before confirming signals)

KAMA Trading Objectives

The KAMA indicator serves multiple missions:

-

Trend identification

-

Market noise and volatility evaluation

-

Turning points estimation

-

Trade signals generation

-

Price movement filtering

-

Filtering trading signals

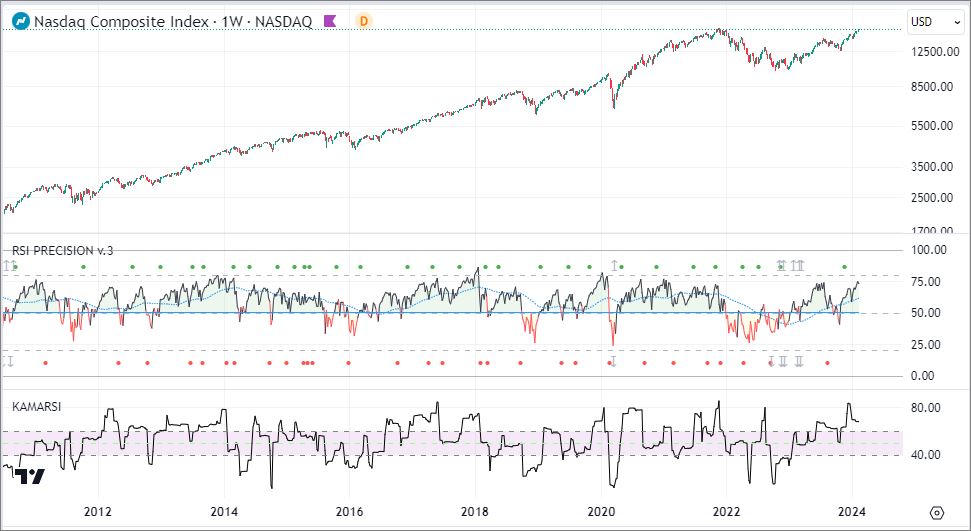

In the following chart, an indicator based on KAMA and RSI Precision on Nasdaq.

Image: KAMA & RSI Precision on Nasdaq (weekly)

KAMA Calculation

■ Basic Settings

The recommended settings by Perry Kaufman include KAMA(10,2,30).

Where:

□ 10 is the number of periods for ER {Efficiency Ratio}

□ 2 is the number of periods for the fast EMA

□ 30 is the number of periods for the slow EMA

Before moving to the calculation of KAMA, we must first calculate the ER (Efficiency Ratio) and then the SC (Smoothing Constant).

■ Calculating the Efficiency Ratio (ER)

The ER is calculated as follows:

□ ER = Change/Volatility

□ Change = Absolute Value {Close - Close (10 periods ago)}

□ Volatility = Sum10 {Absolute Value (Close - Prior Close)}

■ Calculating Smoothing Constant (SC)

This is how we calculate the Smoothing Constant:

□ SC = [ER x (fastest SC - slowest SC) + slowest SC]2

□ SC = [ER x (2/(2+1) - 2/(30+1)) + 2/(30+1)]2

■ Calculating KAMA

After calculating the Efficiency Ratio (ER) and then the Smoothing Constant (SC), we can now calculate Kaufman's Adaptive Moving Average (KAMA):

□ Current KAMA = Prior KAMA + SC x (Price - Prior KAMA)

□ Trading with KAMA (Kaufman's Adaptive Moving Average)

George P. for CurrenciesFx.com (c)

> READ MORE

□ INFORMATION

» Getting Started with Trading Resources

» Forex Signal Services

» Other Financial Markets

□ EDUCATION

» Algorithmic or Mechanical Trading

» Forex News-Trading & Indicators

» Technical Analysis